Angola is the second-largest oil producer in sub-Saharan Africa, behind Nigeria. The country experienced an oil production boom between 2002 and 2008 when production started at several deepwater fields.

The first commercial oil discovery in Angola was made in 1955 in the onshore Kwanza (Cuanza) basin.1 Since that discovery, Angola’s oil industry has grown substantially, despite a civil war that lasted from 1975 to 2002. Currently, oil production in Angola comes almost entirely from offshore fields off the coast of Cabinda and deepwater fields in the Lower Congo basin. Some small-scale oil production occurs from onshore fields, but conflicts have limited onshore exploration and production in the past. In 2007, Angola became a member of the Organization of the Petroleum Exporting Countries (OPEC).

In 2015, Angola produced nearly 1.8 million barrels per day (b/d) of crude oil. Angola’s oil production grew by an annual average of 15% from 2002 to 2008, as production started in several deepwater fields that were discovered in the 1990s. The first deepwater field to come online was the Chevron-operated Kuito field (Block 14) in late 1999.2 Since then, international oil companies (IOCs), led by Total, Chevron, ExxonMobil, and BP, have started production at additional deepwater fields and are in the process of developing new ones.

Angola is a small natural gas producer. Most of Angola’s natural gas production is associated gas at oil fields, and it is vented and flared (burned off) or re-injected into oil wells to enhance oil recovery. Angola lacks the infrastructure needed to commercialize more of its natural gas resources. The country’s new liquefied natural gas (LNG) plant at Soyo was developed to commercialize more of its natural gas. However, the plant experienced chronic problems and was temporarily shut down almost a year after it exported its first cargo to Brazil in June 2013. The plant is expected to resume operations in 2016.

Angola’s economy depends heavily on oil production. From 2011 —2013, the oil sector accounted for about 95% of the country’s total exports, 45% of gross domestic product (GDP), and about 80% of total revenue, according to the International Monetary Fund (IMF).3 Oil revenue as a share of total government revenue dropped to 68% in 2014 because of the drop in oil prices and a decline in Angola’s oil production. Angola earned $23.4 billion in oil revenues in 2014, almost $7 billion less than in 2013. Although Angola’s production increased in 2015, lower oil prices resulted in the country’s oil revenues dropping even further to below $15 billion, although these estimates are still preliminary. Angola’s dependence on oil revenue makes its economy vulnerable to a decline in oil prices. Real GDP growth is projected to be 3.5% in 2015, compared to 6.8% in 2013. Angola’s oil basket averaged $53 per barrel in 2015, down from about $100 per barrel in 2014.4 In April 2016, negotiations began with the IMF for a three-year loan facility of approximately $1.5 billion per year.5

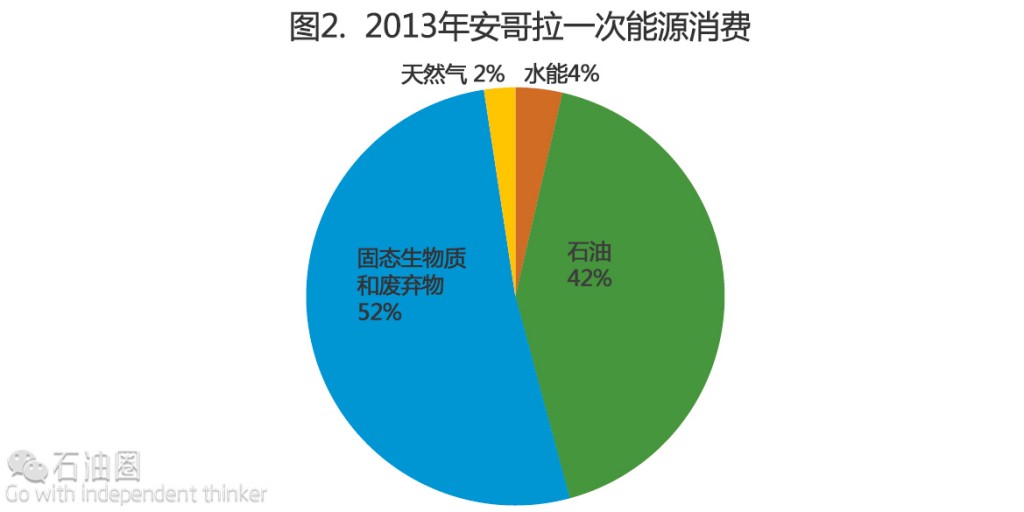

Despite being the third-largest economy in sub-Saharan Africa (in terms of nominal GDP), approximately 37% of Angolans live below the poverty line (less than $1.25 per day), although that proportion has declined substantially from 68% in 2001.6 The latest estimate from the International Energy Agency indicates that only 30% of Angolans had access to electricity in 2013, leaving 15 million people without access.7 As a result, most people use traditional solid biomass and waste (typically consisting of wood, charcoal, manure, and crop residues) to meet off-grid heating and cooking needs, mainly in rural areas where the electrification rate is only 18%.8 In 2013, more than 50% of Angola’s primary energy consumption consisted of traditional solid biomass and waste (Figure 2).9 However, that amount may be understated. Estimates of traditional biomass consumption are imprecise because biomass sources are not typically traded in easily observable commercial markets.

Regulation of oil and natural gas industries

Sonangol, Angola’s national oil company, is a shareholder in almost all oil and natural gas exploration and production projects. International oil companies from the United States and Europe lead oil and natural gas exploration and production in Angola. Companies from China have been increasing their participation in the oil and natural gas industry.

In 1976, the government of Angola created a national oil company, the Sociedade Nacional de Combustiveis de Angola (Sonangol). Sonangol is currently a shareholder in almost all oil and natural gas production and exploration projects in Angola, with the exception of a couple of deepwater projects. Sonangol also operates Angola’s only oil refinery. The company owns 17 subsidiaries that operate throughout the oil and natural gas industry, performing functions such as exploration, production and marketing of crude oil, storage, and marketing of petroleum derivatives.

Sonangol’s key subsidiaries include: Sonangol Pesquisa e Produgao (P&P), which undertakes exploration and production activities for Sonangol in Angola; Sonaref, which runs refining operations in Angola; and Sonangas, which runs Angola’s natural gas sector. Formed in 2004, Sonagas is tasked with the exploration, evaluation, production, storage, and transport of Angola’s natural gas and natural gas derivatives. Sonangas is working with Sonangol P&P to establish a regulatory environment—including taxation—to help spur research and development in Angola’s natural gas sector.10

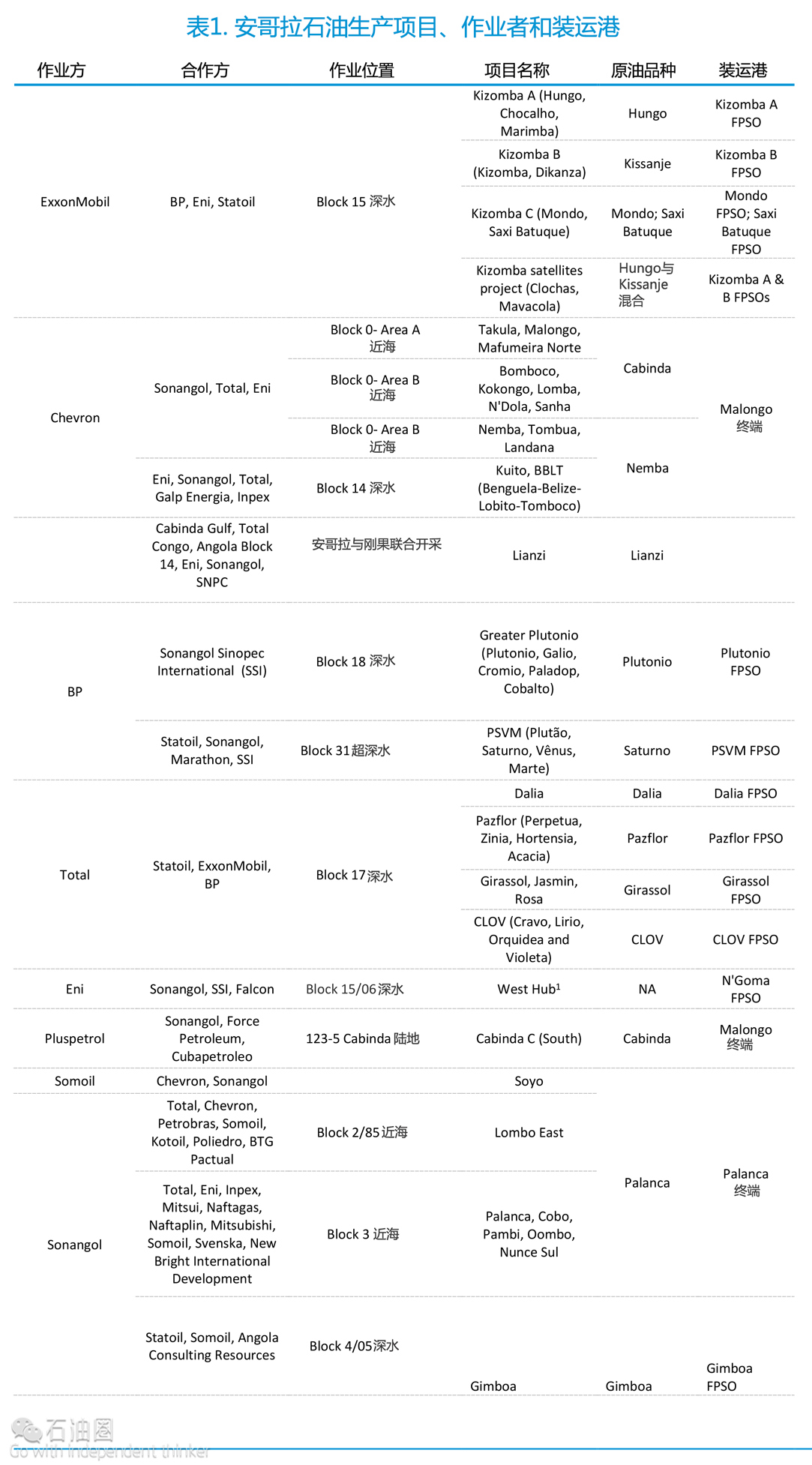

lOCs involved in Angola operate under joint-venture operations and production-sharing agreements (PSAs) with Sonangol. Major operators and shareholders include Total, Chevron, ExxonMobil, BP, Statoil, and Eni, among others. China’s national oil companies—Sinopec and the China National Offshore Oil Corporation (CNOOC) and the Hong Kong-based New Bright International Development—are also involved in Angola and provide development assistance as well as oil-backed loans and trade. China Sonangol, established in 2004, is a joint venture between Sonangol and New Bright International Development. China Sonangol and Sinopec have a joint venture in Sonangol Sinopec International (SSI), which is a non-operator shareholder in three major producing deepwater projects. New Bright International Development is a shareholder in the less prolific assets within Block 3 (see Table 1).11 Questions have been raised about Sonangol and New Bright’s relationship and how the Hong Kong- based company quickly became a dominant player in Angola’s oil industry.

Sonangol is becoming more involved in international ventures, and the company currently has interests in Brazil, Cuba, Sao Tome and Principe, Venezuela, and in the Gulf of Mexico. In early 2012, Sonangol pulled out of Iran’s South Pars-12 natural gas project after U.S. sanctions on Iran were tightened. Sonangol was also forced to pull out of Iraq in 2014. The company had experienced repeated attacks on the oil fields it operates (Qaiyarah and Najmah) because of militant violence in Iraq’s northwest Ninawa Province. Sonangol continues to explore opportunities around the globe, as it aims to establish itself as a major international player.

Angola has strict local content requirements in its oil and natural gas industry. The requirements are under the umbrella of the Angolanization policy, which aims to increase the number of Angolans employed in management positions and Angolans hired as local contractors. The regulations require IOCs operating in Angola to meet a 70% Angolanization threshold, but to date this figure has rarely—if ever—been met. IOCs are also required to use local banks for all their transactions and contribute to training programs in Angola. Companies are expected to fund training programs by providing $200,000 per year per block during the exploration phase of their operations and $0.15 per barrel of oil during the production phase. These regulations are designed to improve the technical and financial capacity of Sonangol, its subsidiaries, and Angola’s citizens.14

In March of 2016, Eduardo Dos Santos, president of Angola since 1979, announced his intent to leave office in 2018. Two months before, Dos Santos announced the appointment of his oldest daughter to chair a committee tasked with restructuring Sonangol and revamping the oil sector.

Petroleum and other liquids

Sonangol has targeted an oil production rate of 2.0 million b/d for a few years, but the company continues to fall short. Frequent technical problems and steep production decline rates at older deepwater fields have resulted in lower-than-expected production levels, despite new fields coming online.

Angola holds 8.4 billion barrels of proved crude oil reserves, according to the latest estimates from the OH & Gas Journal (OGJ) published in January 2016, down from 9.0 billion barrels one year earlier.16 Most of the proved reserves are located in the offshore parts of the Lower Congo and Kwanza basins. Typically, most exploration and production activities have been located in the offshore part of the Lower Congo basin, but the onshore and offshore Kwanza basin is receiving more attention from IOCs because of its presalt formations.

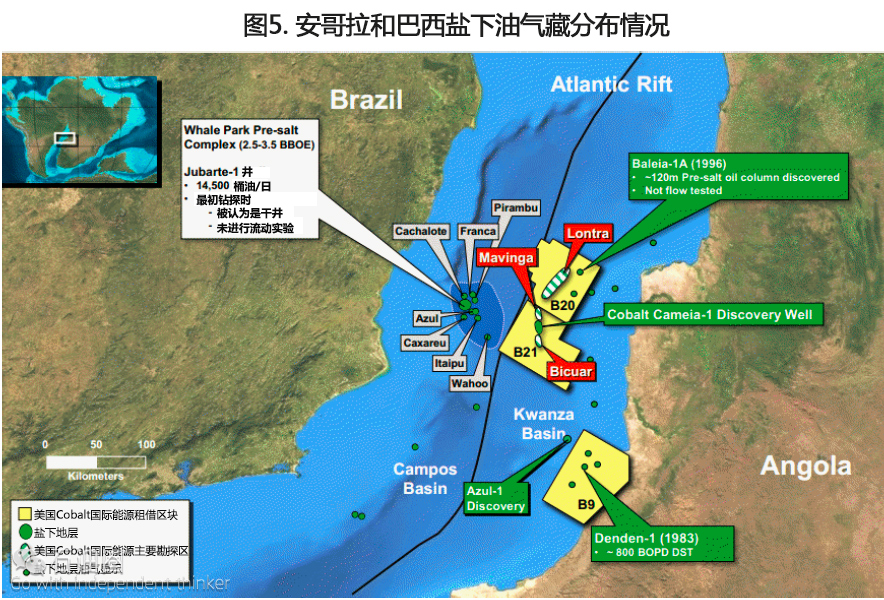

The west coast of Angola (along with some neighboring countries) shares geological similarities with Brazil’s east coast, which contains presalt formations estimated to hold large quantities of hydrocarbon resources. The geological similarities stem from the separation of the African and South American tectonic plates through the Early Cretaceous period, explained by the scientific theory of plate tectonics and continental drift.

Three basins in Angola—the Lower Congo, Kwanza, and Namibe basins—are also believed to be major salt basins. The Kwanza basin, which shares similarities with Brazil’s prolific Campos and Santos basins, is the current area targeted for presalt exploration by the IOCs and Sonangol.

Production and exploration

Oil production in Angola gradually increased from the 1960s to the 1990s, reaching almost 750,000 b/d by 2000. During this period, production came mostly from offshore fields off the coast of Cabinda, an enclave and disputed province of Angola. Deepwater exploration in Angola began in the early 1990s. In 1994, deepwater blocks were licensed out, which led to more than 50 significant discoveries. As a result, between 2002 and 2008 oil production boomed as multiple deepwater fields came online.

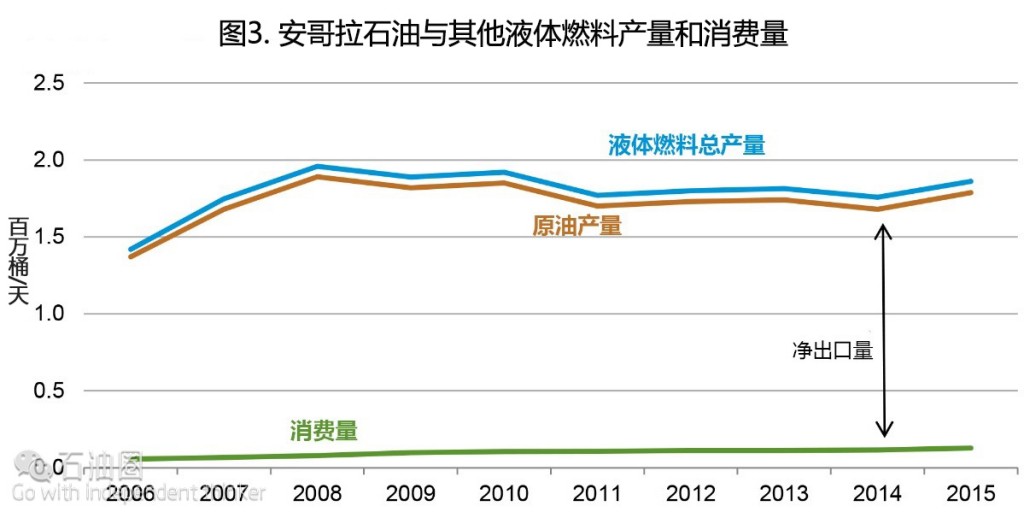

Angola’s total petroleum and other liquids production peaked in 2008, reaching nearly 2.0 million b/d, of which 1.9 million b/d was crude oil (Figure 3). Despite some new oil fields coming online, Angola’s total liquids production has remained relatively stagnant over the past few years, averaging close to 1.8 million b/d from 2011 to 2015. Angola’s flat production is the result of persistent technical problems related to water injection systems, gas cooling and floating, production, storage, and offloading (FPSO) units associated with some projects. The technical problems resulted in lengthy maintenance work and disruptions to production from some fields. Rapid reservoir depletion has also contributed to steep decline rates at some fields.

Several oil projects are scheduled to start production over the next few years in Angola, but the start dates may depend on the current oil price environment. The latest projects to come online were the CLOV (Cravo, Lirio, Orquidea, and Violeta), the West Hub development, the Kizomba Satellites Phase 2, and the Lianzi field (Table 1).17 CLOV, operated by Total, started commercial production in June 2014. CLOV’s production capacity is 160,000 b/d.18 The West Hub development, operated by Eni, started commercial production in December 2014. The West Hub’s production capacity is 100,000 b/d.19 The Kizomba Satellites Phase 2, operated by a subsidiary of ExxonMobil, started production in May 2015. The project included the development of the Kakocha, Bavuca, and Mondo South fields with a total capacity of 70,000 b/d. The Lianzi field, operated by Chevron, started production in November 2015 and is expected to reach 40,000 b/d.20 The Lizani field is located in an offshore zone between Angola and the Republic of Congo (Brazzaville). It is the first cross-border development of its kind in the region.

Angola has at least eight offshore and deepwater oil projects projected to come online in the next 5 to 10 years (Table 2). Of those planned projects, three have received a final investment decision (FID) to develop the project. These three projects could contribute as much as 305,000 b/d of new crude oil production within the next few years. Despite the recent drop in global oil prices, projects that are past the FID stage will not be canceled because the procurement and construction phase has already started. However, project start times could be delayed if global crude oil prices remain low. Because several of Angola’s older deepwater fields are past their peak production, the new capacity additions from the upcoming projects are more likely to sustain Angola’s crude oil production at or slightly above current levels over the medium term rather than provide a substantial boost.

Onshore production and exploration

Most exploration activity in Angola is conducted offshore at depths of more than 1,200 meters (3,937 feet). Exploration activities in Angola’s onshore were limited over the past decades because of the civil war (1975-2002). Over the past few years, onshore exploration has resumed but at a much slower pace than offshore activities.

Recent onshore exploration activity is mostly conducted in the Lower Congo basin onshore area in the Cabinda North and South blocks. Sonangol, with China Sonangol, carries out exploration activity at Cabinda North. Exploration at the onshore Cabinda South block was initially led by Roc Oil Company based in Australia, but was later taken over by Pluspetrol Angola, a subsidiary of Argentinian group Pluspetrol, with partners Sonangol and Cubapetroleo. Exploration at the Cabinda South block initially started in 2007, and production started in late 2013 (Table 1).

Somoil, a privately-owned Angolan company, is pursuing exploration activities in the onshore Soyo areas. Somoil is currently producing small quantities of oil (less than 5,000 b/d), which is being blended and exported with production from the Sonangol-operated fields that make up the Palanca blend (Table 1). Somoil is the only privately-owned company based in Angola that operates oil fields in the country.

Presalt exploration

The first presalt discoveries in Angola were the Denden 1 well in block 9 in 1983, operated by Cities Services at the time, and the Baleia 1A well on block 20 in 1996, operated by Mobil (now ExxonMobil). Both blocks are now operated by the U.S.-based Cobalt International Energy.23 The Danish company, Maersk Oil, made the first recent presalt discovery in the Kwanza basin in late 2011 —the Azul well on block 23. Maersk continues to study the results of the well and plans to appraise it.

Cobalt has had the most success with presalt exploration in Angola, making multiple presalt well discoveries in blocks 20 and 21 (Cameia, Mavinga, Lontra, Bicuar, and Orca). Cobalt’s finds encountered presalt hydrocarbons in the form of liquid and gas. Cobalt is the only company to have made presalt discoveries (Cameia and Orca-1 fields) in Angola that are commercially viable. The company made plans to move toward sanctioning the Cameia field by the end of 2015; however, in August 2015 Cobalt agreed to sell its interest in blocks 20 and 21 to Sonangol.25 The $1.75 billion deal was expected to close in late 2015, but as of this publication, the deal was still delayed. Regardless of ownership, the Cameia project is expected to remain on course and to begin oil production in 2018.

In January 2011, Angola announced that it awarded 11 presalt offshore blocks in the Kwanza basin, following a closed licensing round that a few selected IOCs were invited to. IOCs that were awarded blocks include Petrobras, Maersk Oil, Cobalt, BP, Repsol, Total, Eni, ConocoPhillips, and Statoil. Some of those companies have slowed their investments in Angola’s presalt, and some wells have been closed and abandoned.26 The combination of disappointing results and the geological complexity, compounded by the low oil price environment, has resulted in reduced investment in Angola’s presalt areas. Nonetheless, in August 2015 Angola listed 10 onshore blocks believed to hold presalt prospects in the Kwanza and Lower Congo basins, and again in March 2016 the country announced 15 offshore blocks for auction from the Naimbe and Congo Fan – Lower Congo Basin.

Refining, consumption, and fuel subsidies

Angola has one small refinery that was constructed in 1955. This refinery has a capacity of 39,000 b/d, although it typically operates at 70% capacity.28 Construction on a new Sonaref refinery in Lobito started in December 2012. The refinery will have an initial processing capacity of 120,000 b/d and is scheduled to come online in 2017—18, although the start date has been pushed back before. The refinery’s capacity is scheduled to increase to 200,000 b/d a few years after it opens. The refinery is expected to run on Angola’s crude oil, with refined products sold to domestic and international markets. In December 2013, Sonangol hired Standard Chartered Bank UK to provide financial consulting during the refinery’s construction.

Preliminary estimates show that Angola consumed roughly 130,000 b/d of petroleum products in 2015, more than double the volume consumed ten years earlier. Angola imports about 80% of the petroleum it consumes. Low fuel prices in Angola have contributed to rising oil demand. According to a recent report from the International Monetary Fund (IMF) on fuel subsidies in Angola, fuel prices in Angola are among the lowest in the world. According to 2012 data, the average gasoline price in Angola was 55% lower and diesel 67% lower than the average prices in sub-Saharan Africa. Angola’s fuel subsidies accounted for almost 4% of gross domestic product (GDP) in 2014, which included fuel subsidies for electricity generation. In September 2014, the government raised retail fuel prices by 25% for gasoline and diesel, by 21.6% for liquefied petroleum gas, by 34.6% for kerosene, by 100% for heavy fuels, and by 18.8% for asphalt. The IMF estimated that the increase in fuel prices reduced subsidy costs by 0.5% of Angola’s GDP.30 Angola reduced subsidies again on January 1,2016, leading to a 39% increase in the price of gasoline and an 80% increase in diesel costs.

Exports

Angola has been the second-largest supplier of crude oil to China since 2005, behind Saudi Arabia. The United States, the European Union, and India are also major destinations for Angolan oil. However, U.S. imports of Angolan crude oil continue to decline because of increased U.S. production of similar—quality crude grades.

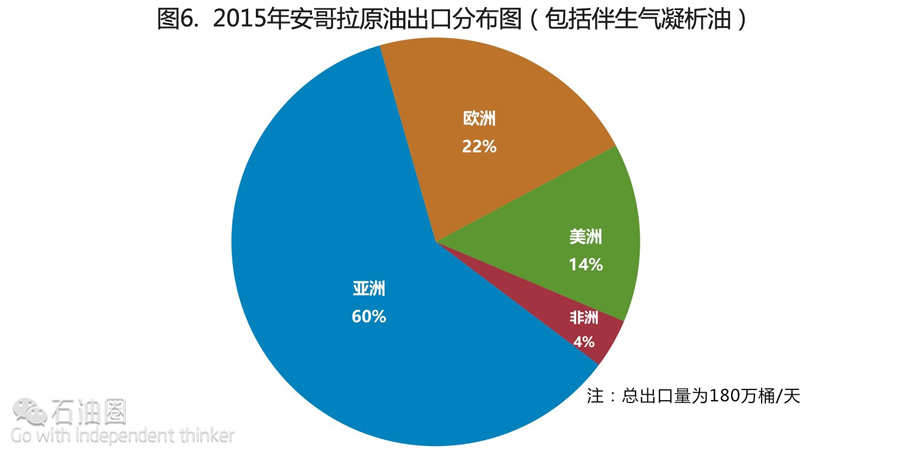

In 2015, Angola exported about 1.8 million b/d of crude oil, including lease condensate, of which more than half went to Asia (60%). Angola has been the second-largest supplier of crude oil to China since 2005, behind Saudi Arabia. Europe (22%) and the Americas (14%) are also major destinations for Angolan oil (Figure 6).32 Most of Angolan crude oil is medium-to-light in density, but some grades, such as Dalia, Pazflor, and Hungo, are heavy grades. Nearly all of Angola’s oil production is exported because Angola’s domestic refining capacity is limited.

The United States has imported oil from Angola since the 1970s. Angola accounted for 5% of total U.S. crude oil imports between 2005 and 2009, supplying the United States with an annual average of 484,000 b/d during that period. U.S. imports of Angolan oil have decreased since then, in terms of the absolute volume and share. In 2015, the United States imported 124,000 b/d of crude oil from Angola, accounting for less than 2% of total U.S. imports. The growth in U.S. light, sweet crude oil production from the Bakken and Eagle Ford has resulted in a sizable decline in U.S. imports of similar—^quality crude grades.

Natural gas

Angola currently produces small quantities of marketed natural gas, but the vast majority of the country’s gross production is flared (burned off) or reinjected into oil wells. In mid-2013, Angola exported its first cargo of liquefied natural gas (LNG) from its new LNG plant at Soyo. However, the LNG plant experienced chronic technical issues, which led to suspension of operations in April 2014.

Angola holds an estimated 10.9 trillion cubic feet (Tcf) of proved natural gas reserves, according to the latest OH & Gas Journal estimates released January 2016. Angola produces small quantities of marketed natural gas, but the vast majority of its production is flared as a by-product of oil operations or reinjected into oil fields to increase oil recovery. Angola lacks the infrastructure needed to commercialize more of its natural gas resources. The country’s new LNG plant at Soyo was developed to commercialize more of its natural gas. However, the plant experienced chronic problems and was temporarily shut down one year after it exported its first cargo to Brazil in June 2013. The plant is expected to return to operation in July 2016.34

Production and exports

Gross natural gas production in Angola was 369 billion cubic feet (Bcf) in 2014, of which 247 Bcf was vented and flared, 89 Bcf was reinjected, and 35 Bcf was marketed (Figure 7).35 Angola’s natural gas production comes entirely from natural gas associated with oil production, although Angola LNG, the operator of the LNG facility, plans to develop some previously discovered nonassociated natural gas fields. With offshore oil exploration continuing apace, Angola will need to address its capacity for processing the large volumes of associated gas its oil operations will continue to produce. Improving LNG capabilities, developing the domestic market for commercial natural gas, and applying enhanced oil recovery techniques will be important components to Angola’s natural gas strategy moving forward.

Angola exported LNG in 2013 for the first time, which totaled 18 Bcf that year.36 The LNG was exported to Brazil, Japan, China, and South Korea.37 The Soyo LNG plant was initially scheduled to begin operations in the first quarter of 2012, but many delays pushed the start date back to mid-2013. Angola LNG is a consortium that includes: Sonangol (22.8%), Chevron (36.4%), Total (13.6%), BP (13.6%), and Eni (13.6%). According to Angola LNG, the $10 billion LNG project represented the largest single investment in Angola’s history. The plant was built with a capacity to produce 5.2 million tons per year (250 Bcf per year) of LNG, as well as natural gas plant liquids. Associated natural gas is sourced from various offshore and deepwater oil fields within Blocks 0, 14, 15, 17, and 18. Angola LNG also plans to develop nonassociated gas fields in Blocks 1 and 2 to feed the LNG plant.

In April 2014, Angola LNG shut down the plant because of continuous technical issues. These problems resulted in infrequent exports while the plant was open. The technical issues the plant experienced include electrical fires, pipeline leaks and ruptures, and a collapsed drilling rig that resulted in a worker’s death. Bechtel, the plant’s contractor, is working to overhaul the LNG plant. The plant is expected to come back online in 2016.

Electricity

Angola’s electricity infrastructure was damaged substantially during its c^^il war (19752002). The Angolan government, with financial assistance from China, has made notable improvements to its power sector, and electricity generating capacity has more than doubled since the end of the war. However, more than half of the country’s inhabitants still do not have access to electricity and rely on traditional biomass and waste to meet their household energy needs.

In 2013, Angola generated 5.8 million kilowatthours of electricity from hydro and fossil fuel sources. More than 70% of its electricity was generated at the country’s hydroelectric facilities, primarily from hydroelectric dams on the Kwanza (Cuanza), Catumbela, and Cunene Rivers. Some analysis suggests that the country’s potential hydroelectric generating capacity is at least 10 times the current installed capacity.

The latest estimate from the International Energy Agency indicates that only 30% of Angolans had access to electricity in 2013, leaving 15 million people without access.41 Some of the problems plaguing the electricity sector include: insufficient power generation, limited revenue collection (more than 80%〇 of users are not metered), high costs for power generation and distribution (diesel fuel used for generation is completely subsidized by the government), and the lack of highly skilled workers to manage the electricity sector.

The Angolan government plans to invest $23 billion in the electricity sector by 2017. This investment will help to improve the country’s transmission and distribution networks, which were significantly damaged during the 27-year long civil war (1975-2002), and to help bring electricity to the country’s remote rural regions, where the electrification rate is only 18%〇.43 The plan proposes to increase overall electricity supplies by more than 10% to help meet rising domestic demand. Angola has also set an ambitious longterm goal to increase hydropower capacity to 9,000 megawatts by 2025 by building as many as 15 new plants, with the help of foreign investment. The government hopes the proposed growth in power generation capacity will double the country’s electrification rate to 60%.

Angola’s electricity sector is dominated by the state company Empresa Nacional de Electricidade (ENE). However, some private companies in the extractive industries have built power plants to provide electricity for their operations. ENE manages and operates Angola’s transmission system, along with more than 80% of the country’s distribution system and power generation plants outside of the capital city, Luanda. Empresa de Distribuigao de Electricidade (EDEL) operates the distribution system in Luanda. Currently, Angola does not have a national electricity grid, and instead the country relies on three independent systems that provide electricity to different parts of the country: the Northern, Central, and Southern Systems. The government hopes to link the three independent grids as part of a national grid system and eventually to link its grid with neighboring members of the Southern African Power Pool (SAPP).

Angola is a member of SAPP, a group that includes Botswana, the Democratic Republic of the Congo (DRC), Lesotho, Malawi, Mozambique, Namibia, South Africa, Swaziland, Tanzania, Zambia, and Zimbabwe. The SAPP is designed to promote cooperation among member countries to create a common electricity market that will provide reliable and affordable electricity to the citizens of member countries.

石油圈

石油圈