天然气作为清洁能源越来越受到青睐,很多国家都将LNG列为首选燃料。海运作为LNG进出口的重要手段是影响LNG贸易的重要因素。作为全球十大独立船东之一,MOL公司在这方面有许多经验,在15年Gastech会议上,该公司分享了这些经验。

来自 | Gastech

编译 | 白小明

上期石油圈的Gastech:LNG经北海/巴拿马航线直抵亚太 船东怎么看?(上)中介绍了MOL公司作为船东在LNG海运市场中的地位以及一些适合NSR和加宽巴拿马运河的船舶,本期石油圈将继续介绍巴拿马运河航线和北海航线船队修理、维护时需考虑因素以及两条航线可能遇到的物流难题。

船队修理&维护时需考虑因素

巴拿马运河航线船队

加勒比海一侧

- 当前,在CAR/USEC(加勒比海/美国东海岸)范围内,巴哈马(Bahamas)有一些用于LNG船的修理&维护(R&M)设施。

- 巴拿马航线的运输船如果想前往法国和伊伯利亚半岛寻找更多的R&M设施,航程会增加3个星期。

- 如果在加勒比海/美国东海岸地区新建R&M设施,会有多大的成本竞争力?何时能够建成?

太平洋地区

- 活跃在太平洋地区的LNG船,通常会前往新加坡或者马来西亚的干船坞进行维修(维护),在日本和韩国也有少量的同类设施,但是费用非常高。

- 如果坚持前往传统干船坞进行维修(维护),那么那些计划将货物运输到东北亚地区后再返回巴拿马的LNG船来说,需要多行驶不少航程。

- KHI(川崎重工业株式会社)和MES(三井造船株式会社)近期宣布,在日本成立了一家专门维修船舶的合资公司—KHI-MES由良船坞(KHI MES Yura Dock),主要服务于新造的LNG船。

- 中国可能将提供相关的服务,且具有一定的成本优势,从而成为东南亚船厂以外的另一项选择。

北海航线船队

虽然当前大多数常规运输船可能每隔5年才维护一次,但正常情况下,Arc 7型LNG运输船每隔两年半就需要驶入干船坞进行维护。

北海航线面临的物流挑战

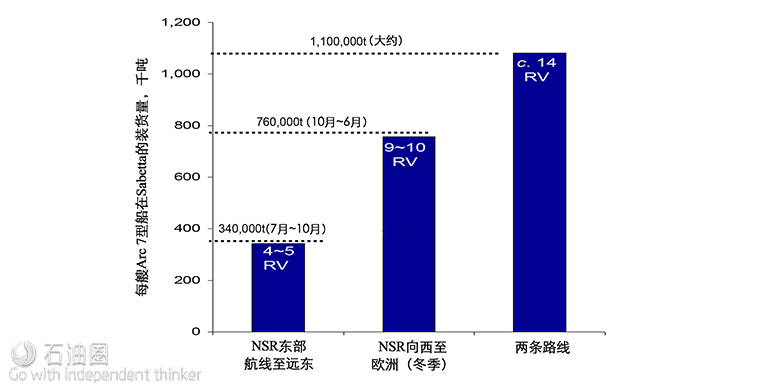

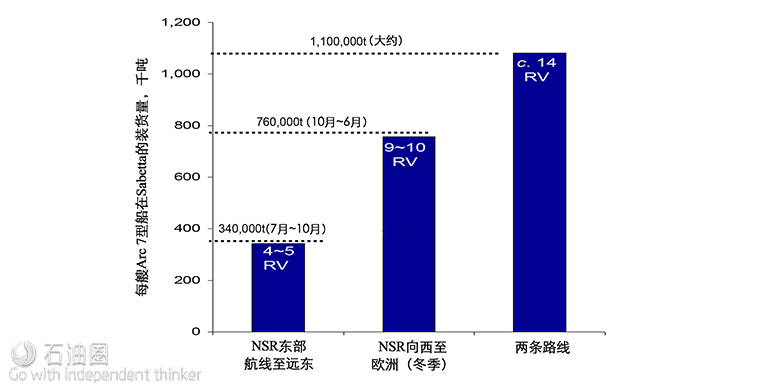

Arc 7型船计划每艘航行14次/年

上图为Yamal LNG项目中NSR两条不同航线的装货量,其中RV为每年往返航程数。

- 至远东的NSR东部航线,仅在夏季6月到初秋的10月通航。

- 在冬季和春季的几个月内,Yamal LNG与比利时的Fluxys签订了合同,转运多达800万吨的LNG到比利时西北部港市泽布吕赫(Zeebrugge),然后转至常规LNG船运输到亚太地区。

- 船队的航行计划中包括较冷月份在欧洲进行修理&维护。

- 有时,在夏季可以使用比Arc 7冰级更低的其它类型的LNG船,从俄罗斯的萨贝塔港(Sabetta)直接装货运至西部目的地。

北海航线技术和运作挑战

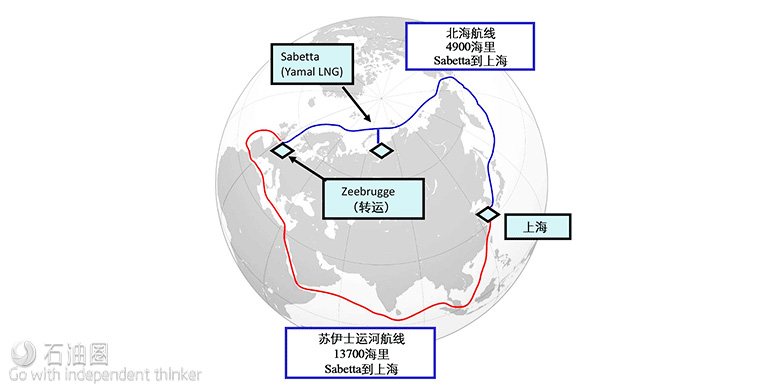

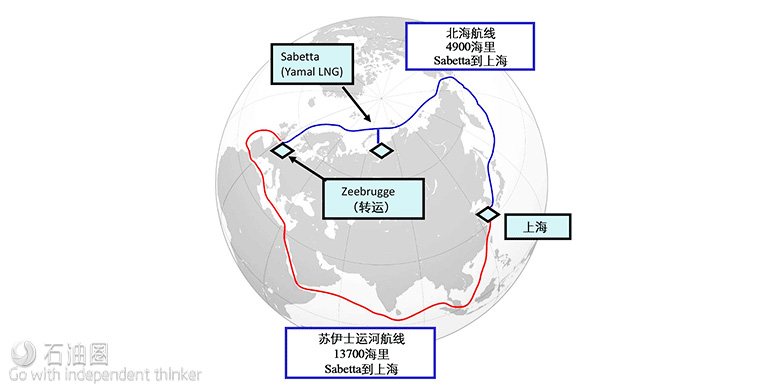

- 与在比利时转船相比,NSR航线大幅缩短了到东北亚的航程(约缩短8800海里)。

- 然而,不论是NSR还是西行航线,对船运公司来说,都面临着诸多环境难题和风险:

不可预知的天气及海况风险—这些风险在北极地区更加明显。该地区的强风可能会导致冰川与船两侧相撞。

冰况预测—目前还缺乏地面监测技术,而地面监测是卫星图像技术的关键补充措施。

结冰风险—虽然受益于全球变暖和冰川线回退,NSR目前的结冰风险较小,但这一趋势能否持续到2045年,以及Yamal项目到期后可能的10年延长期内?

- 北极圈地区还有大量直接关乎人类生存的挑战和风险:

船员相关问题—北极的自然环境对船员的心理和身体状况要求极高,需要在航程开始前接受专业的训练并做好充分准备。

后勤工作相关风险—辅助保障工作是否充足,是否适用于LNG船?引航员及拖船驾驶人员及其他工作人员能否快速适应并操作这些LNG船?

后勤保障工作是成功的关键

- Arc 7船可以应对厚达2.1m的冰层。经过北冰洋西部出口LNG时,为了应对冬季和春季的大范围积冰,需要使用这类破冰船。

- 俄罗斯国家核动力破冰船公司(Rosatomflot)目前经营有5艘核动力破冰船,另外3艘破冰船已经在圣彼得堡的Baltic船厂建造,建成后将履行Yamal LNG项目的22年合同。

- LK-60破冰船,每艘提供60MW动力,最大排水量3.353万吨,长173m,宽34m,设计可以以最大2节/小时的航速冲破3m厚的冰层。

- 除了海上服务,NSR沿线的沿岸设施也是顺利完成航行的重要条件,其中包括用于确认卫星数据的观察哨,用于更新海图和冰况预测情况的测量设施。

- 除此之外,尤其急缺能够与船员保持密切联络的经验丰富的工作人员。

巴拿马运河面临的物流挑战

巴拿马运河航线技术、运作及商业风险

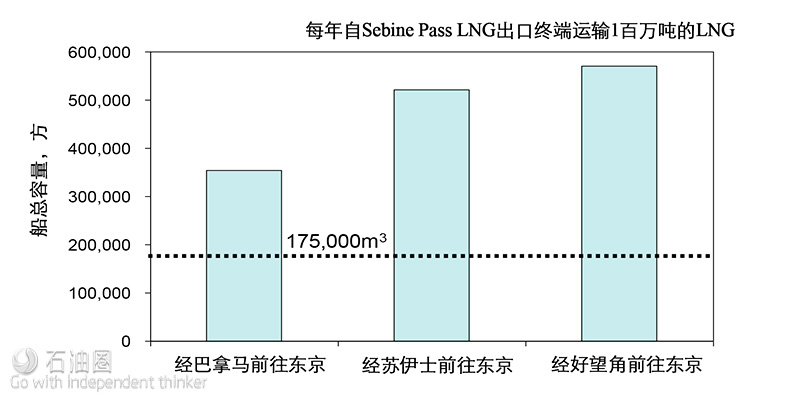

从上图可以看出从哥斯达黎加到东京共有三条航线,分别为:

- 大圆航线(3月~10月),7690海里;

- 夏威夷以北航线(2月~11月),8130海里;

- 夏威夷以南航线(12月~1月),8480海里。

其中:

- 跨太平洋航线—大圆航线(The Great Circle route)在冬季并不适合大多数的LNG船航行,其它季节这些船需要采用更偏南、更远的航线。

- 水文学风险—运河中淡水不足是否影响运营?

- 拥塞、船舶相撞和安全风险—巴拿马运河的这些风险显然比其它航道高。

- 后勤工作风险—辅助保障工作是否充足,是否适用于大型运输船?引航员及拖船驾驶人员及其他工作人员能否快速适应并操作这些LNG船?

- 商业风险—相比其他用户,对LNG船征收的关税对巴拿马运河港口管理局(ACP)的重要程度如何?显然,运河每天单边只有6个不可预定的通行航道可用。

- 通行费涨价风险—由于拓宽工程的费用大幅超支,至少超过2007年计划的52.5亿美元的1/3。未来费用核算时,超支的成本会带来什么影响?

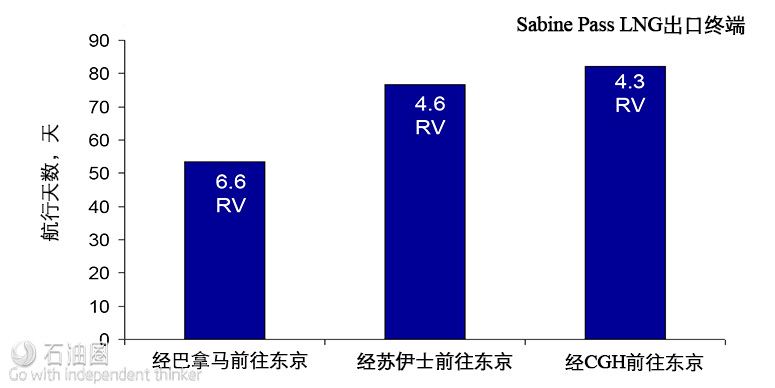

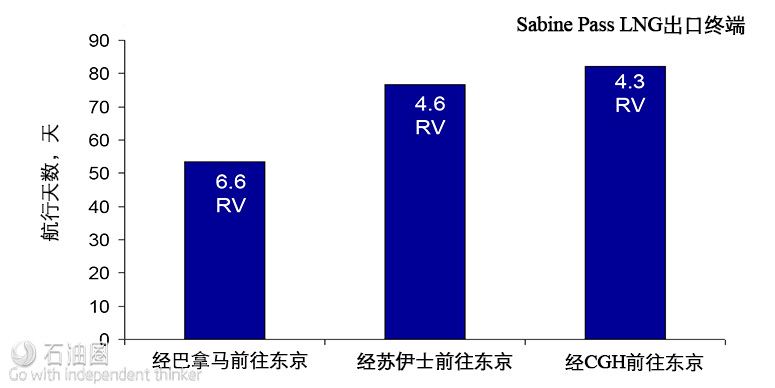

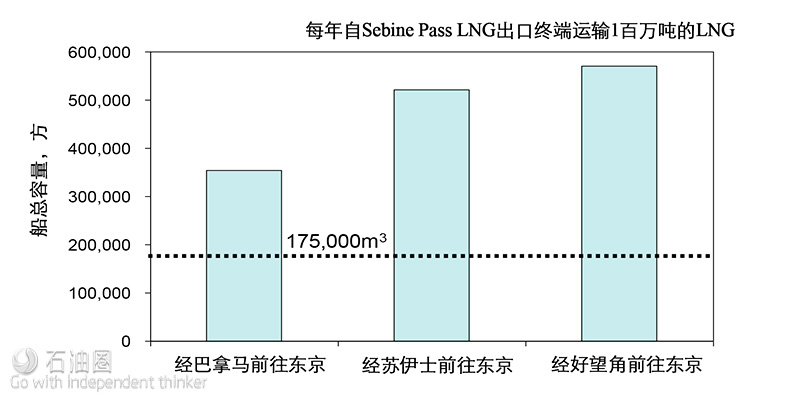

一艘17.5万方的运输船,经由巴拿马运河在美洲湾与日本之间折返航行,每年将可以往返6.6次:

上图三条航线的平均航速分别为16.6节、17.1节和16.5节。

- 上图显示了每条路线的预计航行时间,每年可运输的货物量(假设每5年中断60天进行干船坞维护)。

- LNG船的设计航速通常为19或19.5节,但由于太平洋、好望角及印度洋等地区的商业、不利的气象以及海洋环境等季节和其它因素的影响,实际航速会比设计航速低。

- 实际通过巴拿马运河大约需要1天,但在通过前需要额外的准备时间,且在科隆港(Colon)或巴尔博亚港(Balboa)还要进行重新分配。在苏伊士运河,船舶需要护送才能通过,计划时间通常还包括一天半的等待时间。

- 途径巴拿马,每年运输1百万吨的货物至日本需要2.1~2.2艘17.5万方的运输船。

- 预计到2025年,MOL从美国及加勒比海地区途径巴拿马运输到亚洲约2750万吨的货物,这一数据约等价于整个西行航线(占用65艘船)外加输出到美洲太平洋沿岸的所有货物。

- 途径巴拿马,每年运输1百万吨货物至日本的运力,要比途径南非的航线低38%。

结论

- NSR和巴拿马运河航线,两者均为向亚太地区供应LNG的重要航线。

- 对比大西洋航线,两条航线为向远东地区运输LNG提供了更快、更廉价的方式。

- 然而,在保证NSR、巴拿马航线以及在太平洋和加勒比海等地区航行的安全性和时效性方面,船运公司都面临着极大的技术和运作挑战。

- 除了为NSR及加宽巴拿马运河所研发的新技术外,海上及岸上的人为因素对于顺利完成两条航线的航程也至关重要。

- 船员与海上后勤保障人员,如引航员、拖船和破冰船驾驶人员之间的有效沟通,是顺利完成航程的重中之重。

- 参与美国出口项目的日本运输船、贸易公司及船东的优势,最终将促使各方合作,共同优化东、西方市场整体的船队部署规划。

关于Gastech会议展览

Gastech是全球最大的天然气领域专业会议展览,服务于天然气行业44年,由世界知名展览会组织者英国dmg::event公司主办(阿布扎比石油展、加拿大石油展的组织者),为石油天然气行业内最知名的国际盛事之一。第29届Gastech会议展览将于2017年4月4-7日在日本东京举行,由Jera, Mitsubishi Corporation, Mitsui & Co., Tokyo Gas Co., Ltd, INPEX Corporation, Itochu Corporation, Japan Petroleum Exploration Co., Ltd (JAPEX), JX Group, Marubeni 及 Sumitomo Corporation十家日本企业组成的Gastech联盟共同主办。

这将是您了解全球天然气及LNG价值链最新动态、获取国际前沿能源企业领袖行业见解的不容错过的业界盛会。若想了解请访问网址:www.gastechevent.com/oilsns2或在下方留言。

The fleets’ repair & maintenance considerations

The Caribbean Side

- Currently, in the CAR/USEC area, the Bahamas has some R&M facilities suitable for LNG carriers

- More extensive R&M facilities in France and Iberia would require 3 weeks’ additional sailing time for ships dedicated to Panama routes

- How cost competitive would any new R&M facilities in the CAR/USEC area be and when might they be built?

The Pacific area

- LNG carriers trading in the Pacific have usually been drydocked in Singapore or Malaysia; there being few other facilities, or only at high cost in Japan and South Korea

- Adherence to the traditional dry-docking centres would entail a lengthy diversion for LNG carriers supplying cargoes to north-east Asia and returning to Panama

- KHI and MES recently announced a joint-venture company for ship repair – KHI MES Yura Dock – in Japan, principally to serve the new generation of LNG ships

- China may eventually offer a cost-competitive alternative to the South East Asian yards

The Northern Sea Route (NSR) fleet

The Arc 7s are to be dry-docked every 2.5 years as has traditionally been the case in LNG although most conventional ships now enter dock every 5 years

Northern Sea Route Logistical Challenges

Each of the 15 Yamal LNG Arc 7s are expected to perform about 14 voyages per annum

The NSR eastbound route to the Far East will be open only during the summer and early autumn, from about June to October

- During the winter and spring months, Yamal LNG has contracted with Fluxys to transship up to 8 million tonnes at Zeebrugge primarily for onward passage to the Asia-

- Pacific on conventional LNG carriers

- The fleet voyage schedule will include provision for repair & maintenance in Europe during the colder months

- Occasionally, other LNG carriers with a lower ice-class than the Arc 7s could be used to load cargoes directly from Sabetta to western destinations during the summer

The NSR presents myriad technical and operational challenges

The NSR offers a substantially shorter route to north-east Asian destinations – some 8,800nm – compared with transshipment through Belgium as made evident in this global depiction

However the NSR, and its westbound counterpart present various environmental difficulties and risks to operators as follows:

- Unpredictable weather and sea state risks – these are naturally more hazardous in Arctic regions. High winds pose the threat of icebergs colliding with the sides of the ships

- Ice forecasting – there is a lack currently of ground-based surveillance as a vital supplement to satellite imagery

- Ice risks – the NSR has been a beneficiary of global warming and ice retreat, but will this trend last until 2045, and for a possible 10 years’ Yamal extension period thereafter?

The Arctic also has more than a fair share of human-related challenges and risks

Crew-related issues – the environment poses significant psychological and physical demands on crews, requiring specialist training and prior preparation

Support services’ risks – Will ancillary services be suitable and adequate for LNGCs, and how quickly will pilots, tug masters and other personnel adapt to handling these ships?

Adequate support services along the NSR is a critical success factor

- Arc 7s can cope with ice of up to 2.1m thickness. To clear more extensive accumulations during the winter and spring – when LNG exports are directed through the western Arctic – icebreakers will be used

- Rosatomflot has 5 nuclear-powered icebreakers in operation and 3 more on order from Baltic Shipyard in St. Petersburg to fulfill a 22-year contract with Yamal LNG

- The LK-60 icebreakers – each delivering 60 MW power – have a displacement of up to 33,530 tonnes, are 173m long, 34m wide, and designed to break through 3m ice at up to 2 knots per hour

- Aside from marine services, shore facilities along the NSR are an important pre-requisite to successful operations, including observation posts for corroboration of satellite data, measurement of water depths for chart updating, and for ice forecasting

- Above all there is a pressing need for more experienced personnel, trained to liaise closely with ships’ crews

Panama Canal Logistical Challenges

The Panama Canal also presents various technical, operational and commercial risks

- Trans-Pacific navigation – The Great Circle route is not suitable for most LNG ships during winter months, requiring them to take a more southerly and lengthier passage during the other seasons

- Completion risks – the Canal expansion was originally due to be completed in 2014 and, following a series of delays and stoppages, is now expected ready during first quarter of 2016

- Locks’ operating risks – will the new locks in the Canal work?

- Hydrological risks – will any lack of fresh water in mid-Canal affect operations?

- Congestion, collision & security risks – naturally higher in any waterway

- Support services’ risks – Will ancillary services be suitable and adequate for the bigger vessels, and how quickly will Pilots, tug masters and other personnel adapt to handling LNG ships?

- Business risk – How important is LNG shippers’ custom going to be for the ACP compared with other users. Apparently, only 6 non-bookable transit slots are to be made available in each direction per day

The ACP has suggested a reservation system that would allow for the auctioning of scheduled transit slots, but this has not been finalised

Tolls’ escalation risks – there has been a significant overrun in expansion cost – at least a third more than the original $5.25bn figure when work began in 2007. What impact will cost overruns have during future toll reviews?

A 175,000m3 ship plying the USG-Japan via Panama route should be able to perform about 6.6 round voyages p.a.

- The graph shows the estimated days’ sailing on each route, and the number and quantity of cargo deliverable annually assuming 60 days’ off-hire per 5-year dry-docking cycle

- The design speeds of LNG ships are typically 19 or 19.5kt, but due to commercial factors or adverse meteorological & oceanographic conditions, particularly in the Pacific, Cape of Good Hope and Indian Ocean mean that sailing speeds would be lower depending upon the season and other factors

- The actual Canal transit is expected to be about one day, but additional time would be needed prior to entry, and for regular re-provisioning of the LNGC at either Colon or Balboa. In the Suez Canal, where vessels transit in convoys, the scheduled time used including waiting is typically 1.5 days

- 2.1~2.2 x 175,000m3 ships would be required on the Panama route to export 1 mmtpa to Japan

- Our 2025 base case of 27.5 million tonnes to Asia from the U.S. and Caribbean via Panama is equivalent to about 1 westbound transit per day – occupying around 65 ships – plus whatever is exported to the Americas Pacific coast

- The capacity to deliver 1 mmtpa to Japan via the Panama is 38% less than on the route around South Africa

Concluding Remarks

- Both the NSR and Panama Canal are set to be important conduits for new LNG supplies to the Asia-Pacific

- Both routes offer a faster and cheaper means of delivering LNG to the Far East as compared with via the Atlantic

- However, ship operators face myriad technical and operational challenges in ensuring safe and expeditious transit of the NSR and Panama Canal, and in the Pacific an Caribbean too

- Aside from the novel technologies developed to use the NSR, and expand the Panama Canal, human factors – both on shore and at sea – are critical to the success of operations on both routes

- Effective communication between the seafarers and marine ancillary services’ staff, such as the pilots, tug and icebreaker masters, will be of paramount importance

- The predominance of Japanese utilities, trading houses and ship owners engaged in US export projects offers the prospect of eventually cooperating to optimise overall fleet deployment between markets in the east and west

未经允许,不得转载本站任何文章:

-

- 白矾

-

石油圈认证作者

- 毕业于中国石油大学(华东),油气井工程硕士,长期聚焦国内外石油行业前沿技术装备信息,具有数十万字技术文献翻译经验。

石油圈

石油圈