Crude oil is the world’s most actively traded commodity, and oil-related trades are a staple for traders, hedgers, investors around the globe.

The below infographic, put together by Aspect, covers the history of crude oil trading, while also highlighting the major events that have shaped the landscape of the oil market as we know it today.

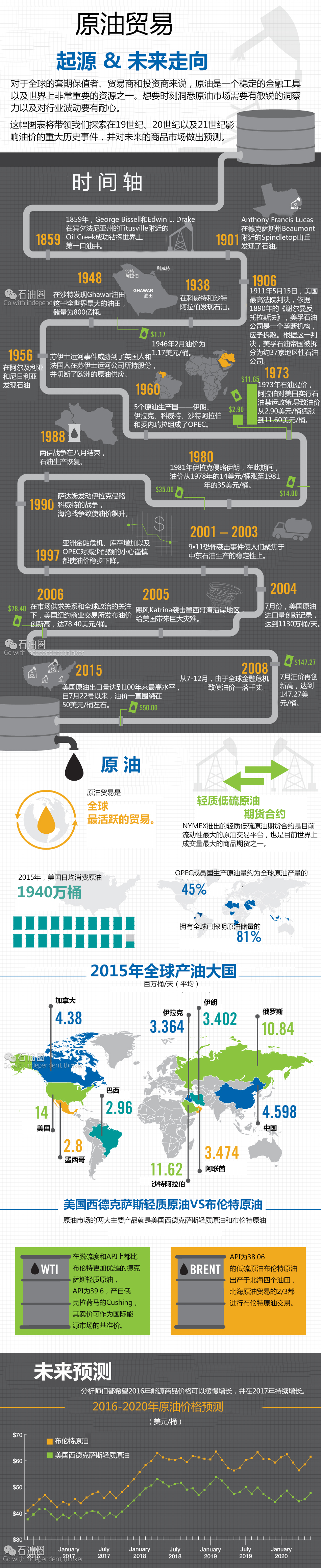

THE HISTORY OF CRUDE OIL

The infographic serves as the perfect primer for all the questions about oil that you had, yet were afraid to ask. It also illustrates the impact that unexpected geopolitical events can have on the oil price – and how this volatility can be contagious to other global markets.

WHERE IT BEGAN & FUTURE PREDICTIONS

Crude oil is a stable financial instrument for hedgers, traders and investors around the globe and one of the most significant resources in the world. Keeping up with crude markets requires a keen attention to detail as well as patience in what is typically a volatile industry.

This infographic will explore some of the key historical events that contribute to the fluctuating crude oil prices throughout the 19th, 20th and 21st centuries as well as a look at future predictions of the commodity market.

EVENT TIMELINE

George Bissell and Edwin L. Drake made the first successful use of a drilling rig at the site on Oil Creek near Titusville, Pennsylvania.

Captain Anthony Francis Lucas discovered oil at Spindletop Hill near Beaumont, Texas.

The U.S. government sued Standard Oil Company under the Sherman Antitrust Act);in 1911, it was ordered to separate itself of its major holdings into 33 smaller companies.

Oil discovered in Kuwait and Saudi Arabia.

A record low of $1.17 in February 1946

Ghawar field discovered in Saudi Arabia – the largest conventional oil field in the world contains about 80 billion barrels.

The Suez Crisis threatened British and French stock holdings in the Suez Canal Company as well as cut off Europe’s oil supply.

1956年,Oil discovered in Algeria and Nigeria.

5 oil-producing countries-Iran, Iraq, Kuwait, Saudi Arabia and Venezuela, formed OPEC.

Arab Oil Embargo on the United States-oil prices rose from $2.90 to $11.60.

Iraq invades Iran. During this time, crude oil prices increased from $14 per barrel in 1978 to $35 per barrel in 1981.

1988年The Iran-Iraq War ended in August. Oil production resumed.

Saddam Hussein launched the Iraqi invasion of Kuwait. The price of oil spiked due to the Gulf War.

The Asian economic crisis, increased inventory and OPEC’s wariness to reduce quotas leads to a steady decline in oil price.

The September 11th attacks raised concerns about the stability of the Middle East’s production.

U.S. oil imports at a record 11.3MMBO per day in July.

Hurricane Katrina struck the Gulf Coast of the U.S. with devastating results.

Oil hit a record high of $78.40/bbl on NYMEX on supply and world political concerns.

2008年Crude oil price hit a record high over $147.27per barrel in July.

The global financial crisis caused prices to plummet 78.1% from July to December.

U.S. output reached its highest level in more than 100 years. Prices hover near $50 a barrel as of July 22.

Crude oil is the world’s most activity traded commodity.

The NYMEX FUTURES CONTRACT is the world’s most liquid forum for crude oil trading. It is also the world’s largest volume futures contract trading on a physical commodity.

In 2015, the United States consumed an average of 19.4 million barrels per day.

Members of OPEC produce about 45% of the world’s crude oil, and possess almost 81% of the world’s total proven crude oil reserves.

LARGEST OIL PRODUCERS IN THE WORLD IN 2015

MILLION BARRELS A DAY (AVERGE)

UNITED STATES、 CANADA、MEXICO、 BRAZIL、 IRAQ、 SAUDI ARABIA、 IRAN、UNITED ARAB EMIRATES、 RUSSIA、CHINA

WTI CRUDE VS BRENT CRUDE

The majority of Crude oil comes from two main sources of production; West Texas intermediate (WTI) and Brent

Sweeter & lighter than Brent-also known as Texas light sweet API gravity of 39.6 Originates from Cushing, Oklahoma Used as a benchmark in oil pricing.

Sweet, light crude oil API gravity of 38.06 Originates from 4 oilfields in the North Sea 2/3 of all crude contracts use Brent.

FUTURE PREDICITIONS

Analysts expect energy commodities prices to increase slowly throughout 2016 and to continue to rise in 2017.

石油圈

石油圈