Whether you’re selling water, a game-changing app, or tacos, you need tank-ers, or an app store, or a modified trailer with a slide window and an awning to get your product to market.

The Oil and Gas industry is so big that we have broken it up into three sepa-rate industries: Upstream–which is focused on finding and extracting hydro-carbons from the earth. Midstream –which is focused transporting hydrocar-bons from the Upstream, storing, and delivering them to. Downstream – which includes refineries, gas stations, city gas supplies, and Hank Hill.

Of course there is some overlap and integration between the sectors – Mid-stream may do some processing for Natural Gas Liquids, and may be involved in the delivery of wholesale refined product to retail outlets, for example. Natu-rally, our posts here focus mainly on upstream concerns, but I thought it would be useful to examine midstream operations. I’m going to focus primarily on liq-uids (oil, condensate, NGLs), since gas is a little more, um, elusive.

TRANSPORTATION

Let’s start with the myriad methods of transporting hydrocarbons.

Trucks – very common for collection, although since it’s the most custom, it is the most expensive – you have to pay for a driver to transport each load. Typ-ical tanker truck capacities range from around 5,500 to 11,600 U.S. gallons – between 131 and 276 barrels. This effectively adds a surcharge to wildcatted wells, or wells that are not near a hub. If you have a well producing 50 bar-rels a day, you’re going to have to send a tanker truck out every 3 to 5 days or so.

Trains – very common, particularly to deal with very large quantities across long distances that don’t have pipeline infrastructure built out. Although like with tanker trucks you still have to deal with loading and unloading individu-al train car loads, the enormous distances that can be covered with a relative-ly small crew, make trains more economically reasonable by far than truck-ing. The standard DOT-111 tank car has a maximum capacity of 34,500 gal-lons – around 821 barrels.

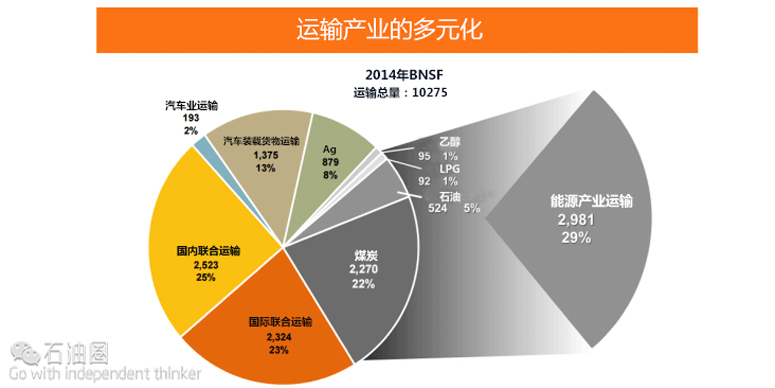

This was during the height of production in 2014. Coal still makes up the larg-est portion of the energy traffic on BNSF trains. Image Source: BNSF Presen-tation EIA Conference 2015

Pipelines – for getting across land, pipelines are going to be your most relia-ble and most economic bet. The following image shows some of the transport costs, and just because it’s clearest with Alberta, we’ll use that example. To get crude from Alberta to the eastern Canada refineries by rail it will cost you $9 to $10/bbl (making your $50/bbl more like a $40-$41/bbl). Whereas to pipe-line that crude down to Cushing only costs $5-$6/bbl (and then another $2-$4 to Houston, so…)

Barges – for short trips along the coast, barges may be the best alternative – just load the existing tank cars on and then off at the destination.

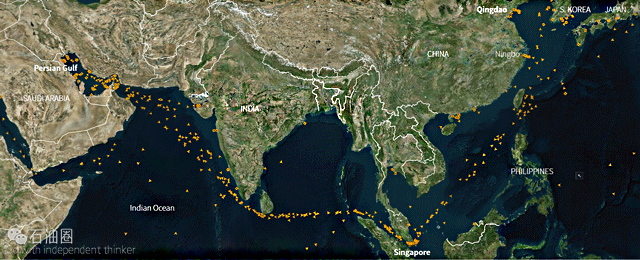

Tankers – there are a variety of tankers – smaller inland and coastal vessels, but mostly when we think of tankers, we think of the VLCC – Very Large Crude Carriers – which are capable of transporting around 2 million barrels of oil at a go, and the above image indicates a transatlantic cost of $2-$3/bbl. One of the big improvements in the Panama Canal was the ability for them to larger tankers, although not nearly VLCC size. Most VLCCs are engaged in the Middle-East to Asia, since there they lack the pipeline infrastructure of, say, north America.

Crude congestion:Huge traffic jams of tankers have formed around the world with some 200million barrels of oil either waiting to be loaded or delivered as ports struggle to cope with record volumes in perhaps the most visible sign of the global oil glut.

Almost all of the over 660 Very Large Crude Carriers(VLCCs),the largest tankers in use to transport seaborne oil,are used to ship crude between the Middle East and Asia’s consumption hubs around India and the Far East.The map above shows all of these super tankers in operation on April 11.

STORAGE

In our recent post Logistical and Physical Storage Constraints Have Outsize Effect On Crude Oil Price Swings, we took a look at some of the methods we use to measure storage, and also how some of the reports about storage vol-umes can have an enhanced effect on pricing sentiment among oil traders.

Cushing – Cushing, OK is a major oil trading hub, with approximately 80 mil-lion barrels of crude oil storage capacity, and dozens of significant pipelines flowing in and out. Because of its central location, the price of West Texas In-termediate (WTI) grade oil is set with Cushing as the delivery point. There is additional storage capacity throughout the states, particularly along the gulf coast, but Cushing is the bellwether.

Tankers – since VLCCs can carry up to around 2 million barrels each, in times of over-supply they become defacto storage Currently we’re seeing about 10,000,000 barrels of crude floating in parked vessels off the coast of Houston, and the above image from Reuters references and approximate 200 million barrels currently in VLCC storage.

In transit – to be fair, if we count VLCCs as storage, then why not tanker trucks and DOT-111s and pipelines? Particularly in these times of excess supply – if we have no-one who can take the oil from us, then it will be stored where it sets. The proposed Keystone XL pipeline was set to be 36” in diameter and 1179 miles long. By my napkin, that works out to 3.14 (pi) X 1.52 (r2 ft) X 5280 (ft in a mile) X 1179 (number of miles) = 44 million ft3 X 7.48 gallons (gallons in a cubic foot) = 329,000,000 gallons / 42 (gallons in a barrel) = 7.8 million bar-rels. So Keystone XL would have been able to take away and deliver 700,000 barrels a day, but there would always be 8 million barrels in it.

CRACKS, FRACTIONS, AND DELIVERY

In a previous post we discussed The Bigger Picture of Local Oil Price Points, and I thought we could revisit that, as well as the blended nature of wellhead production with a mind towards midstream.

Today as I write this section, it is Jun 23. On Bloomberg the posted price for a barrel of WTI Crude Oil at 2:08 PM is $49.68, which is good – definitely better than those $46 barrels earlier this week. If I look into the future a little bit at the Chicago Mercantile Exchange, we see $49.69 for August (up $0.56 for the day) and $50.33 for September, $50.82 for October and so on with a moderate yet steady contango.

But today if you are delivering crude oil (outside of hedges or swaps or other previously agreed terms) to, say, Plains All American (a 4 million BPD mid-stream service company), the price you will receive is based on the previous-ly settled market price. Furthermore the quality of the crude you deliver and the location that you deliver to will have a further impact.

If you deliver WTI crude into the system in most of the Permian Basin with a posted gravity between 40.0 and 44.9 API you will receive $46.50/bbl for your crude. Also, Central Oklahoma, North Texas, Eagle Ford, same deal. Heck if you deliver some of that north Louisiana Nacatoch you’ll get another $2.00/bbl!

Effective 7:00A.M. June 23,2016,subject to change without notice and subject to its division orders and other contracts,Plains Marketing,L.P. will pay the following prices per barrel of 42 U.S.gallons each adjusted for American Petroleum Institute(API)gravity for merchantable quality virgin crude oil and condensate delivered for its account into the custody of its authorized carrier or receiving agency.

However in most cases you will see that other locations of delivery and quali-ty of crude are prompting a $0.50 to $9.00 (or more) discount per barrel. And wait, there’s more! The rightmost column leads to a series of footnotes that further describes additional discounting should your API fall out of the pre-scribed range.

石油圈

石油圈