往日不可留,来日犹可待。如今海上油气正处于新项目投资、老油田二次开发的关键节点,如何运作,才能确保油公司和油服公司重新盈利?

作者 | Espen Erlingsen etc.

编译 | 白小明 甲基橙

北海和墨西哥湾(GOM)是全球重要的两个海上油气产区,昔日这两个地区的产量占全球海上油气总产量的20%左右,油气投资占全球的25%。受低油价影响,如此大体量的油气区块曾一度发展停滞,未来将如何重获繁荣呢?

北海&墨西哥湾:油气生产趋势极为相似

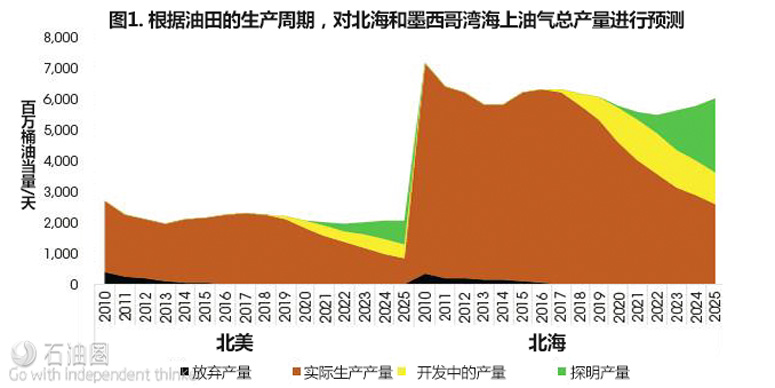

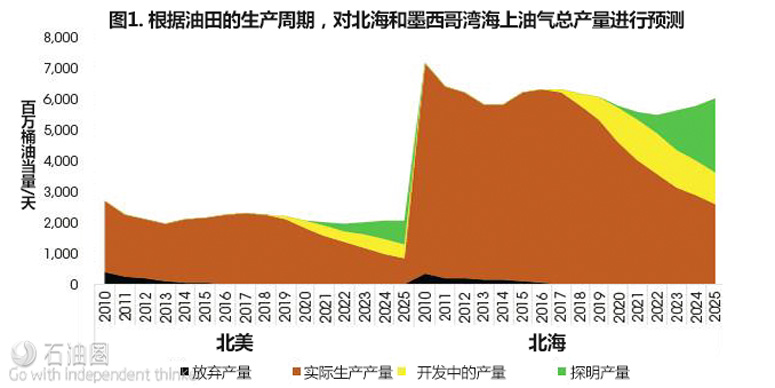

从海上油气生产的历史数据来看,这两个地区的趋势非常相似,它们在2000-2013年间均经历了产量的大幅减少:北海的油气产量从1000万桶油当量/天下降到了600万桶油当量/天,而墨西哥湾的产量则从400万桶油当量/天,下降到了200万桶油当量/天。

从2014年开始,两个地区产量下降的趋势均有所改变,产量再次增加。这一结果源自一批新项目的获批,以及成熟油田的二次开发。在北海,新开发油田包括Knarr、Gudrun、E. Grieg、Laggan和Jasmine油田;二次开发的成熟油田,包括Valhall、Ekofisk和Eldfisk。在墨西哥湾,主要是一些深水项目限制了产量的下降,如Lucius、Jack/St. Malo和Delta House等油田,正不断成为新的产量来源。

从中期来看,由于近年来获批项目较少,预计产量将有所下降。北海地区在未来五年的油气生产下降量可能多达100万桶油当量/天,而相同时期内,墨西哥湾可能的产量下降量约为30万桶油当量/天(图1)。

两地区的竞争优势凸显

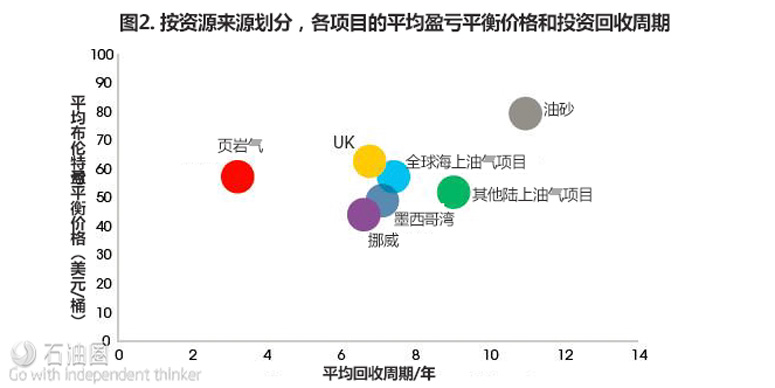

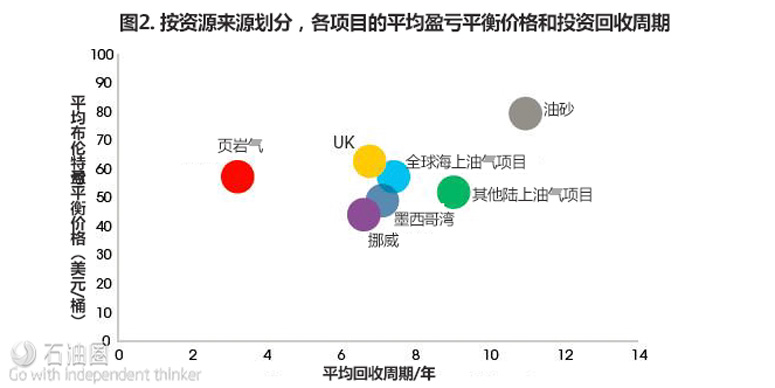

当前,北海和墨西哥湾都在同其他油气资源争夺投资,因此,有必要考虑两个地区的竞争力情况。图2描述了挪威、墨西哥湾和英国新项目,以及其他油气资源的盈亏平衡价格和投资回收周期。

由图2可知,挪威和墨西哥湾一些未获批项目的平均盈亏平衡价格低于50美元/桶,低于未来几年即将批准的一些其他油气资源项目。事实上,相比于页岩气,挪威项目的盈亏平衡价格还要低10美元/桶。

事实上,正是由于北海和墨西哥湾地区相比于其他地区的油气资源项目更具有竞争优势,挪威著名能源咨询公司Rystad才敢大胆预测,预计未来在这些地区将会上马一些新项目。随着获批项目的增加,到2019年投资也将增加,这将有助于缓解生产递减造成的产量停滞,最终产量会随之增加。另外,由图2可知,北海和墨西哥湾项目的盈亏平衡价格在40-50美元/桶之间。

两地区发展同步 都获批了哪些新项目?

1. 新获批准项目渐增

自2013年以来,两个地区获批的项目数量呈下降趋势。2010-2013年,北海地区每年都有15亿桶油当量的新资源项目获批,而2016年,这一数字仅为2亿桶油当量。在墨西哥湾地区,2010-2013年,这一指标平均每年为7亿桶油当量,而2016年为3.3亿桶油当量,新项目的减少影响了之后的支出和中期产量。

许多项目受低油价影响而延迟,但勘探生产公司通过改变思路,降低了项目相关的成本,Rystad能源公司预计从2018年开始,两个地区获批的项目数量会再次增加。此外,随着油价逐步回升,许多准备中的项目将获批。在北海地区,未来3年约有20亿桶油当量的资源开发项目将获批,而对于墨西哥湾地区,这一数字为8.5亿,也相当可观。

2. 大型项目有哪些?

图3统计了未来几年,预计将获批的一些大型项目。最大的要数位于巴伦支海的Johan Castberg项目,该项目的作业者为挪威国油,最终将以FPSO(浮式生产储油)装置生产,预计在2018年获得最终的批准。挪威国油及其合作伙伴一直在努力降低该项目的成本,并改变开发思路。总的来说,盈亏平衡价格从80美元/桶下降到了35美元/桶。

第二大项目是Johan Sverdrup二期,二期项目包括一个新的处理平台和海底基础设施,未来它们将把产量从约40万桶/天增加至约60万桶/天。

Kaskida是墨西哥湾地区即将获批的最大项目,该项目所在油田为高温高压油田,并于2009年被发现。下第三系地层的另一个发现是阿纳达科公司的Shenandoah油田,阿纳达科将继续进行评价工作,预计采用半潜式平台进行开发。

另外两个有趣的油气发现是Wisting和Alta/Gohta,连同Johan Castberg,这些项目将使巴伦支海地区成为重要的油气产区和北极地区重要的区域。为增加这些项目的预计资源量并提高项目的商业性,未来2年在该区域将会新开钻一批评价井。

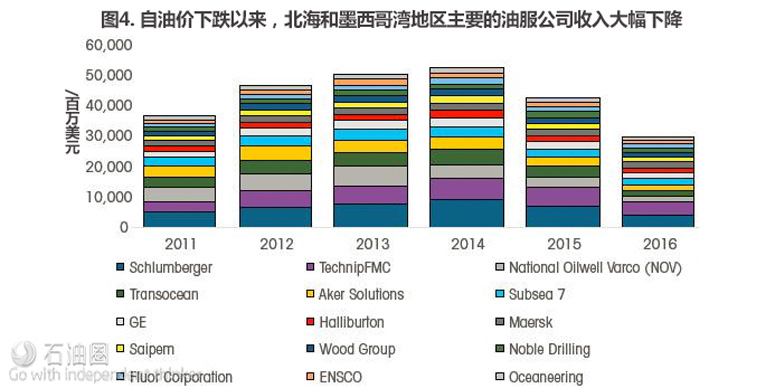

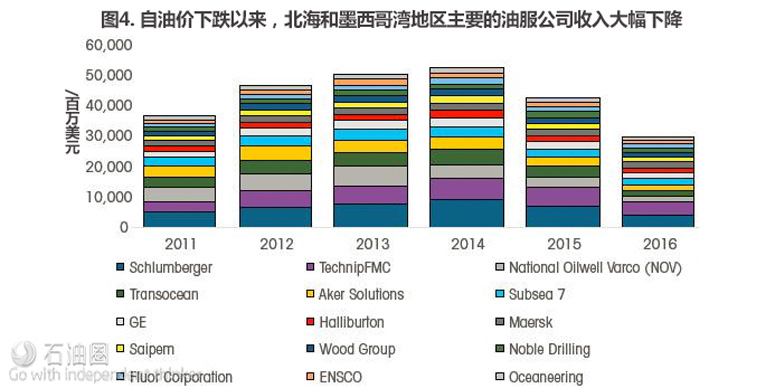

油服市场随油价跌宕起伏

近两年来,低油价对油服公司造成了极大的影响。北海和墨西哥湾地区的油服公司的收入已经从2014年的峰值减少了42%。在经历了五年连续以13%的速度增长后,自2015年开始,勘探生产公司缩减了投资,油服市场开始经历艰难时刻。像NOV、Transocean和Subsea 7等一些公司,收入减少更是超过了50%(图4)。

2010-2014年间的高油价,助推了墨西哥湾和北海地区许多新油田的开发。一些大的开发项目,如墨西哥湾地区的Jack/St. Malo、Mars B和Big Foot项目,以及北海的Goliat、Martin Linge和QUAD204项目,给油服公司带来了前所未有的高收入,也催生了油服业的大繁荣。

但2014年新获批项目数量逐渐减少,再加上许多项目在2015年终结,油服公司在这两个地区的订单数量骤减。无独有偶,其他地区油服公司的业务量减少得更多,如北美陆地,许多公司的收入减少了60%以上。

海上油服市场前景几何?

尽管油价在2016年有大幅回升,但就油服工作需求量来说,2017年仍然比2016年更疲软。随着行业实际服务单价的逐渐降低,预计北美和西欧市场规模将分别收缩15%和7%。

好消息是,在经历了两年的项目停滞后,勘探生产公司愿意重新批准一些新项目。一些如Mad Dog二期、Kaikias和Johan Castberg等新项目的获批表明,油气公司有能力提高这些地区海上油气项目的经济性,并控制项目风险,使它们更具竞争力。

可想而知,这些新项目短期内不可能获得可观的回报,想要弥补现有油田支出的减少可能需要一定的时间,但随着今明两年油价在50-65美元/桶之间波动,未来可能会有更多的项目获得批准。

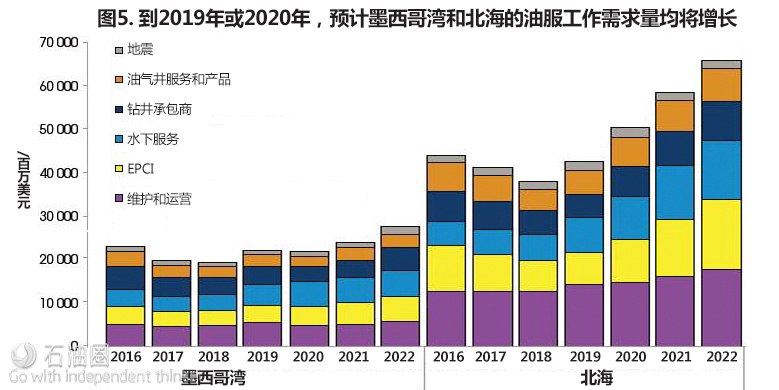

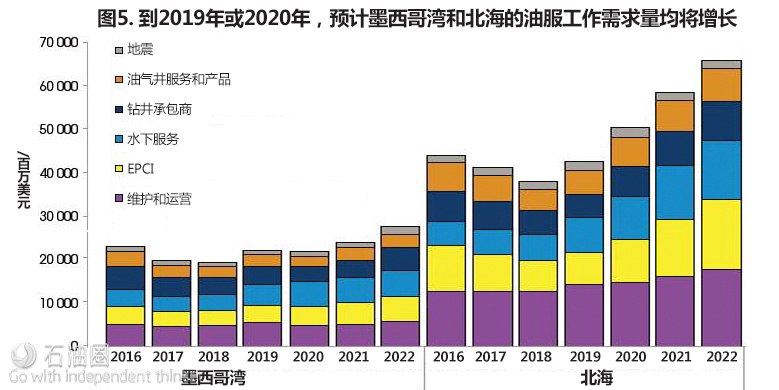

挪威的Johan Sverdrup二期、英国的Rosebank项目,以及墨西哥湾的一些小型水下回接项目的重启,将共同促使这两个地区有望从2019年开始利润大增。

不同部门的市场增长情况各不相同,工程、采购、施工和安装(EPCI)以及维护、改建和运营这两大市场似乎最有前途,预计在2016-2022年,平均复合增长率分别为13%和7%。对于其他市场,年增长率预计将在4-6%的范围以内。得益于项目投资开始大幅向大型的独立项目倾斜,EPCI市场快速增长,相比许多小型的水下回接项目,EPCI的工作量将会更多(图5)。

对于早期已经开始复苏的业务,供应商应该着力于维护和运营市场,预计这一领域将从2018年开始增长。一些新油田项目,如Kraken、QUAD204、Gina Krog和2017年将要投产的Jack二期,将促使公司间签订更多新的框架协议。从2018年开始,一些已经被延迟的老油田维护项目将重启,届时油服公司将重新公开招标。

另一个将在2018年开始增长的油服市场是水下业务,一些老油田需要进行维护或更换一些海底设施。其他市场预计将从2019年开始增长,届时新的油气开发项目将全速启动。

油服业回暖只能仰仗高油价?

在行业经历了如此巨大的调整后,需要一段时间才能全面复苏。即使未来10年油价在90-100美元/桶,市场也无法在2024年之前回到2014年的水平。如果油价长期保持在50美元/桶,油服市场将面临巨大的挑战,预计将维持2017年的水平。

目前的情况并不是缺乏待批准的潜在项目,即使是一些一流的项目,也可以改善成本基础,但由于其复杂性,这并不适用于所有已发现油气资源而待批准的项目。对于储量较小的油田、高温高压油田、重油和存在其他复杂因素的油田,许多开发项目的盈亏平衡价格通常高于60美元/桶。

因此,要真正看到北海和墨西哥湾地区的油服市场东山再起,油价必须上涨到这一水平之上。如果达不到,那么油服公司就必须在其他地区寻找新的业务增长点了。

New Projects Will Contribute To Growth

Espen Erlingsen and Audun Martinsen, VP Analysis, Rystad Energy

The Gulf of Mexico (GoM) and the North Sea are two of the key global offshore regions. Together these two regions account for about 20% of the global offshore production and represent 25% of global offshore investments. This article will take a closer look at how these regions will develop going forward.

Production

Looking at historical offshore production, the trends have been similar for the two regions. Both the North Sea and GoM experienced a considerable decrease in production from 2000 to 2013. During this period the North Sea production declined from 10 MMboe/d to 6 MMboe/d, while the GoM production declined from 4 MMboe/d to 2 MMboe/d.

From 2014 the declining trend was broken for both regions, and production started to increase again. This was a result of the sanctioning of new projects and the redevelopment of mature producing fields. In the North Sea new fields such as Knarr, Gudrun, E. Grieg, Laggan and Jasmine started up, while mature assets such as Valhall, Ekofisk and Eldfisk were redeveloped. In the GoM it was the deepwater projects that halted the production decline, with Lucius, Jack/St. Malo and Delta House being the primary sources of new production.

In the medium term production is expected to decline due to the lack of sanctioning activity over the last few years. The North Sea production could drop as much as 1 MMbbl/d over the next five years, while GoM production could drop about 300 Mboe/d during the same period (Figure 1).

Competitiveness

As both the North Sea and GoM are competing with other sources of production for investments, it is important to consider competitiveness. Figure 2 illustrates this by showing the average breakeven price and payback time for different sources of new production compared to new projects in Norway, the GoM and U.K.

Figure 2 shows how the average breakeven prices for nonsanctioned projects in both Norway and the GoM is less than $50/bbl and lower than all the competing segments for projects to be sanctioned in the coming years. In fact, the Norwegian projects have a breakeven price that is $10/bbl lower than shale.

The fact that the North Sea and GoM are competitive with other sources of production is a key reason why Rystad Energy expects activity to improve for these regions going forward. Increased sanctioning activity will result in an increase in investments in 2019. This also will contribute to the stagnation of the production decline and eventually lead to an increase.

Sanctioning activity

Since 2013 the sanctioning activity in both regions has been trending downward. From 2010 to 2013 1.5 Bboe of new resources were sanctioned yearly in the North Sea compared to 200 MMboe in 2016. In the GoM the average was 700 MMboe annually during 2010 to 2013 compared to 330 MMboe in 2016. The reduced activity has affected spending and the medium-term production outlook.

Many projects were delayed due to the low oil price, but as E&P companies improve the concept and reduce the costs associated with these projects, Rystad Energy expects the sanctioning activity in both regions to increase again from 2018. Furthermore, as the oil price gradually improves, many projects are in the pipeline to be sanctioned. In the North Sea, about 2 Bboe of new volumes could be approved over the next three years, while that number is 850 MMboe for the GoM.

Figure 3 shows the largest projects that are expected to be sanctioned over the next few years. The single largest project is Johan Castberg in the Barents Sea. The Statoil-operated discovery will be developed as an FPSO unit and could get the final approval in 2018. Statoil and its partners have worked on reducing the costs for this project and have changed the development concept. In total, the breakeven oil price has dropped from $80/bbl to about $35/bbl. The second largest project is Phase 2 of Johan Sverdrup. Phase 2 consists of a new processing platform and subsea infrastructure, which will increase the plateau production from about 400 Mbbl/d to about 600 Mbbl/d.

Kaskida is the largest discovery in the pipeline for upcoming sanctioning in the GoM. This HP/HT field was discovered in 2009. Another discovery in the Lower Tertiary is Anadarko’s Shenandoah discovery. Anadarko is continuing to appraise this discovery and is planning for a semisubmersible development solution.

Two other interesting discoveries are Wisting and Alta/Gohta. Together with Johan Castberg, these projects will transform the Barents Sea to an oil-producing province and a key Arctic region. To increase the resource estimates for these projects and improve the commerciality, several new prospects are being drilled in this area within the next two years.

Spending and oilfield service market

The low oil price environment has affected oilfield service companies dramatically over the last two years. In terms of revenue, companies exposed to the service market in the North Sea and GoM have experienced a decline of 42% from the peak in 2014. After five years of consecutive growth of 13% on average, the market came to a hard stop in 2015 when E&P companies put on the brakes to halt investments. The revenue was reduced by more than 50% for some companies such as NOV, Transocean and Subsea 7 (Figure 4).

The high oil price from 2010 to 2014 stimulated many new field developments in the GoM and North Sea. Large developments such as Jack/St. Malo, Mars B and Big Foot in the GoM and Goliat, Martin Linge and QUAD204 in the North Sea caused a record high inflow of contracts to service companies, which led to one of the largest booms in the service industry. The low volumes of sanctioned projects in 2014 coupled with many projects being completed in 2015 resulted in reduced backlogs for service companies. However, service companies in many other regions experienced larger drops such as onshore North America, where revenues fell by more than 60%.

Although oil prices have recovered substantially during 2016, 2017 still looks to be weaker than 2016 in terms of oilfield service purchases. As effective unit prices in the industry are still falling, the market is expected to contract by 15% and 7% in North America and Western Europe, respectively. The good news is that E&P companies are willing to sanction new projects again after two years of drought. Project commitments such as Mad Dog Phase 2, Kaikias and Johan Castberg show that it is possible for companies to improve the project economics for offshore fields in these regions and make them competitive. It will take some time before these new projects offset the decline of spending in existing fields, but with oil prices hovering between $50/bbl and $65/bbl for this year and next year, there is likely to be much more activity in terms of project sanctioning. Phase 2 of Johan Sverdrup in Norway, the revival of Rosebank in the U.K. and smaller subsea tiebacks in the GoM will stimulate spending growth from 2019.

In terms of the market growth for various segments, the engineering, procurement, construction and installation (EPCI) market and maintenance, modification and operation market looks the most promising, with an average compounded growth of 13% and 7%, respectively, from 2016 to 2022. For the other segments the annual growth is expected to lie in the range of 4% to 6%. The rapid EPCI growth is due to the portfolio of projects being heavily tilted toward larger standalone developments with a large EPC scope rather than many small subsea tiebacks (Figure 5).

For early recovering segments, suppliers should look after the maintenance and operations market, which is expected to grow from 2018 onward. The new fields, such as Kraken, QUAD204, Gina Krog and Jack Phase 2 commencing production in 2017, will generate many new frame agreements. A lot of delayed maintenance at aging fields will be up for grabs by service companies from 2018 onward, when this work is overdue.

Another service segment that will witness growth in 2018 is the subsea market, where brownfield activity will drive intervention and replacement of equipment for subsea installations. For other segments growth is expected from 2019 onward, when the development of new resources is at full speed.

After such a deep cut in this market it will take some time before the industry experiences a full recovery. Even with oil prices of $90/bbl to $100/bbl for the next decade, the market will not be back to 2014 levels before 2024. If oil prices are kept at $50/bbl long term, this service market will remain highly challenged and is expected to stay at 2017 levels. There is not a lack of potential projects to be sanctioned, but even though some best-in-class projects have shown stellar improvement in the cost base, this cannot be enforced for the complete portfolio of discovered but nonsanctioned projects due to complexity. With smaller reserves, HP/HT, heavy oil and other complex factors, breakeven prices are typically above $60/bbl for many developments. Hence, for the North Sea and GoM oilfield service markets to truly see a comeback, oil prices will need to improve above these levels. If not, service companies will need to look elsewhere for growth.

未经允许,不得转载本站任何文章:

-

- 甲基橙

-

石油圈认证作者

- 毕业于中国石油大学(华东),化学工程与技术专业,长期聚焦国内外油气行业最新最有价值的行业动态,具有数十万字行业观察编译经验,如需获取油气行业分析相关资料,请联系甲基橙(QQ:1085652456;微信18202257875)

石油圈

石油圈